Usually, when a particular currency is trending up against the US dollar, the noncommercials

tend to register a net long position since these large speculators tend

to ride on the existing trend. The opposite situation is true too: the non-commercials

tend to register a net short position when a particular currency is trending down

against the US dollar. Knowing whether this category has been net long or short a

few days ago only indicates to us the positioning in retrospect; this information is

only useful if you compare the latest net positioning with the positioning figures

from the past few weeks or months

By comparing the latest net positioning with that of the past few weeks or months

you can tell if the latest net long or net short positioning is skewing towards an

extreme reading. My observation of the financial markets is that dramatic price

moves, usually at major turning points, tend to occur when the majority of the market

is positioned incorrectly. And since the large speculators are more inclined to close

their losing positions than the commercial hedgers, it is beneficial for us to keep an

eye on their net directional positioning as well as their net contract volume in the

currency futures market. If these large non-commercials are positioned on the wrong

side of the market, you can expect liquidation of these positions, with the extent of

liquidation depending on the total volume of contracts traded in the wrong direction

For example, if these large funds are holding large (extreme) net long GBP

positions, but GBP is declining against the US dollar due to some external catalysts

like news, they will eventually have to close their longs when their stops are

triggered, or decide to close their longs before getting stopped out and switch to

shorting GBP on the way down. Such mass unwinding of positions tends to bring

about a powerful price move in the opposite direction which could last for a few

days, and it is this turning point that you could detect with the COT data before the

reversal scene actually plays out

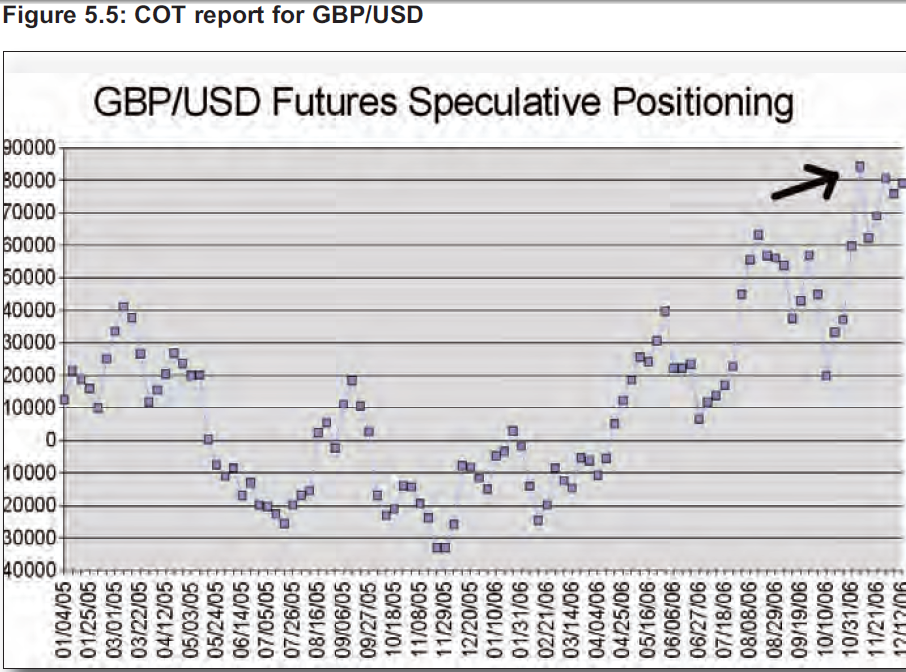

Example: COT – using extreme position

17,2006-An example of this was played out in the week through November 13

. The COT report that was released on November 10

showed that, as of the previous Tuesday on November 7, large

speculative funds upped their net GBP longs to a multi-year high of

+84,280 contracts, a figure which clearly shows up as an extreme

positioning on the chart as shown in Figure 5.5

In this case, all those who had the intention to go long on GBP had

already done so. As a result of this extreme net speculative

positioning of GBP longs on the CME, GBP/USD in the spot market

proceeded to decline by more than 300 pips in the following week

.through November 13-17, 2006 (Figure 5.6

This chart shows the net speculative (

non-commercial) positions in GBP

futures on the CME. X-axis displays the dates for every three weeks even

though the data for every week is shown on the chart. Y-axis displays the net

number of speculative contracts. Positive numbers indicate net long

positioning, while negative numbers indicate net short positioning